Windows becomes premium OS as Microsoft and OEMs “finally get tablets right”

- 24 November, 2015 05:45

It has been a long bumpy road for Windows tablets but 2015 proved to be the year that Microsoft and its partner OEMs finally got tablets right.

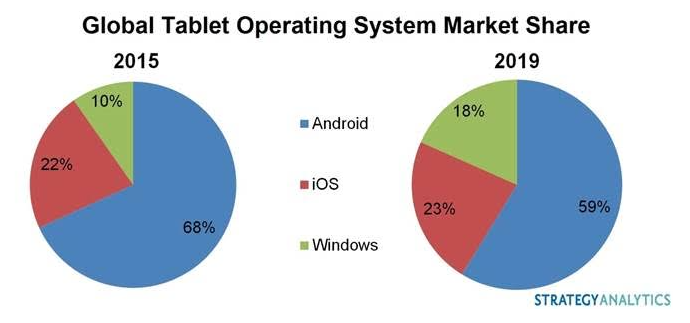

That’s according to new findings from Strategy Analytics, which reports that Windows tablet shipments have already increased at a 58 percent annual rate in the first nine months of 2015 and momentum will carry through the holiday season to reach 22 million shipments for the full year, or 10 percent of the total market.

“As the enterprise market becomes increasingly open to the wide scale deployment of tablet platforms, Microsoft has a key advantage,” says Peter King, Research Director, Tablet & Touchscreen Strategies.

“Its operating systems are found on the vast majority of PC and servers within the enterprise, potentially providing a smoother integration of tablets using the Windows OS into the enterprise.

“Most, if not all, major vendors will have high to premium tier Windows tablet offerings by the end of 2016 to address prosumers and enterprise currently served by Microsoft's Surface Pro line.”

King adds however that Android and iOS competitors will not stand still as Windows gains in popularity.

Black Friday deals are knocking off at least $US100 from iPads, Samsung Galaxy Tabs, and LG G Pads, among many other deals around the industry.

Furthermore, Apple has strengthened its position among enterprise and prosumer users with the iPad Pro release this month, opening the tablet market to even greater penetration of higher-tier prosumers, creatives/artists, and enterprise users.

The report claims that Windows Tablets will have a more balanced approach than Android’s mass market, low cost appeal, but will nevertheless produce many millions of sub-$US150 wholesale ASP tablets, contributing to growing market share.

“Windows Tablet market share has dwindled in the mid-single digit range for the last few years but Windows devices now run the gamut from 2-in-1 tablets by E-Fun in the US starting at $US139 retail, to Microsoft’s Surface Book starting at $US1499 retail,” adds Eric Smith, Senior Analyst, Tablet & Touchscreen Strategies.

“Power, graphics, and functionality aside, Windows 10 provides a stable base from which the ecosystem can grow and we are entering a world where Windows tablets take significant market share from Android tablets on the low end and compete head-to-head with iPad in the high and premium segments.”

Going forward, Smith believes the success of 2-in-1 tablets like the Asus T100, Acer Switch, and the Lenovo Miix 700 and professional grade Slate tablets like the iPad Pro and Surface Pro 4 will introduce more stability for overall ASPs, and providing a path for many Tablet vendors to reap higher profit margins.

Premium price tier tablets will play an important role in the market, particularly in the enterprise market and as PC replacements in general.