As wearables market grows, end-users demand innovation

- 29 February, 2016 06:39

The worldwide wearable device market took a big step forward in the fourth quarter of 2015 (4Q15), fuelled by the growing popularity of fitness trackers and the Apple Watch.

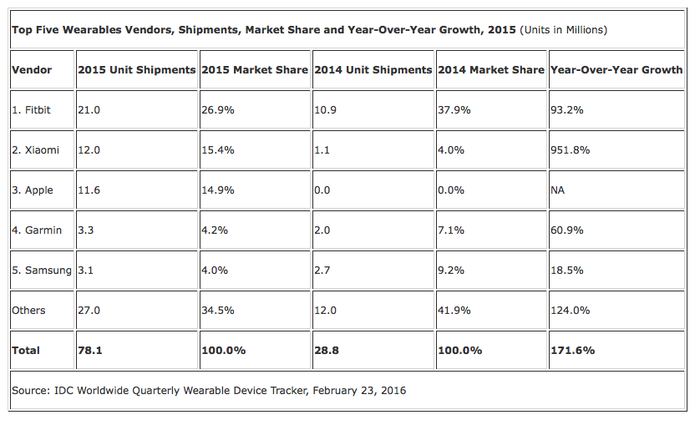

According to IDC findings, vendors shipped a total of 27.4 million units during the holiday quarter, besting 4Q14 levels by 126.9 percent while for the full year, vendors shipped a total of 78.1 million units, up a strong 171.6 percent over 2014.

“Triple-digit growth highlights growing interest in the wearables market from both end-users and vendors,” says Ramon Llamas, Research Manager of Wearables, IDC.

“It shows that wearables are not just for the technophiles and early adopters; wearables can exist and are welcome in the mass market.”

Since wearables have yet to fully penetrate the mass market, Llamas believes there is “still plenty of room” for growth in multiple vectors: new vendors, form factors, applications, and use cases - “this will help propel the market further.”

“What is warranted is continued innovation and development,” Llamas adds. “The market can only get so far with 'me too' and 'copycat' wearable devices.

“End-users expect improvement from what they have now, and new applications to spur replacement and increased adoption. Historical data, like steps taken and calories burned, has been a very good start.”

Llamas believes that prescriptive data, like what else a user can do to live a healthier life, coupled with popular applications like social media, news, and navigation, will push wearables further, and attract more users.

“Fashion and design will play an equally important role in increasing adoption,” adds Jitesh Ubrani, Senior Research Analyst for Mobile Device Trackers, IDC.

“Simply encrusting your watch with gold and jewels is not going to cut it. Rather forming partnerships with notable fashion icons, a route taken by Fitbit and Apple, is far more likely to succeed.

“It's also worth noting that the wearables market isn't just about smartwatches and fitness bands.

“Though the top five certainly dominate with wrist-worn devices, there's been an immense amount of growth in other form factors like clothing, footwear, and eyewear - form factors that arguably require even more fashion sense than watches or bands.”

Vendors

Llamas says Fitbit ended the year the same way it began the year: as the undisputed worldwide leader of wearable devices.

The same drivers were in play: a well-segmented device portfolio, a fast-growing corporate wellness program, and extended market reach around the world.

“2016 shows new hardware development with a watch (Fitbit Blaze) and a fashion-oriented wristband (Fitness Alta), while the company remains true to its fitness tracking DNA,” Llamas adds.

Meanwhile, Apple grew its Watch distribution, enjoyed holiday promotions, and drove the company's overall 'Other Products' revenue during 4Q15.

“However, volumes for the quarter grew only slightly from the previous quarter and total revenues have yet to counterbalance the slowing growth and declines from the company's other product categories,” Llamas adds.

“Expectations are higher for the next-generation Watch that can leverage the company's platforms (HealthKit, ResearchKit, WatchKit, and watchOS 2) and connectivity capabilities.”

In addition, Llamas says Xiaomi's focus on inexpensive fitness trackers resonated within China, with prices far below the competition (as low as $US11), making the Mi Band an inexpensive purchase.

For Llamas, this allowed Xiaomi to have the largest year-over-year improvement of any vendor on our list.

“Xiaomi's latest device, the Mi Band Pulse, continues that tradition ($US13) even as it adds constant heart rate monitoring,” Llamas adds.

“This puts the company on a more even playing field with other vendors, but not enough to stand out against the crowded market.

Further down the line, Samsung finished just ahead of Garmin to take fourth place during the quarter.

Driving volumes was its Gear S2, which caught attention for its bezel-based user interface and its optional cellular connectivity.

Beyond the Gear S2 were legacy devices including the year-old Gear S and the two-year old Gear Fit.

“The company recently begun experimenting with other form factors, including a smart belt, NFC-connected suit, and footwear,” Llamas adds.

Finally, Llamas reports that Garmin's long history with wearable fitness translated well for the company to remain among the top five vendors worldwide.

Garmin has a well-segmented device portfolio, with devices that specifically address runners, golfers, swimmers, citizen athletes, and followers of other activities.

Recently the company announced Varia Vision, an augmented reality display that mounts to a pair of sunglasses for cyclists.